In the quiet corners of financial offices across America a transformation is taking root. It is not loud or flashy but it is powerful. Gen Z and Millennials are quietly rewriting the rules of retirement and they are doing it with an entirely different set of tools than their parents ever imagined.

For years the 401(k) had been the retirement planning sacred cow. A symbol of stability. A playbook passed down with pride. But now a new generation is ripping out the old pages and filling them in with something more fluid, faster and decidedly digital.

A Shift from Tradition to Innovation

Back in the good old days, a solid 401(k) portfolio held up mutual funds with stable performance, low fees and a long-term focus on balance. Boomers and Gen Xers held on to tradition buying broad market funds along with healthcare real estate and blue-chip dividend stocks. It was a security-and-certainty philosophy.

But young investors aren't having it. With traditional pensions evaporating and the cost of living rising, the old playbook no longer works for many of them. Instead they are choosing to take risks, seek returns and invest in ideas that resonate with the future.

Based on the latest data from Investors Observer, increasingly Gen Z and Millennials are now owning ETFs in their 401(k)s. The figures are impressive. Seventy-five percent of Gen Z and 81 percent of Millennials are investing in ETFs versus only 60 percent of Boomers.

The Emergence of ETFs and Thematic Investing

At the heart of it is the ETF or exchange-traded fund. They are very flexible investment instruments that enable an affordable method of diversification of holdings, and they are the pride of younger savers. Why? Because they provide access to industries that are shunned by traditional mutual funds.

Thematic ETFs led by technology have gone through the roof. Fintech. AI. Clean energy. Cybersecurity. Young investors aren't investing in the market, they're investing in ideas. They're opting for ETFs that represent their vision for the future.

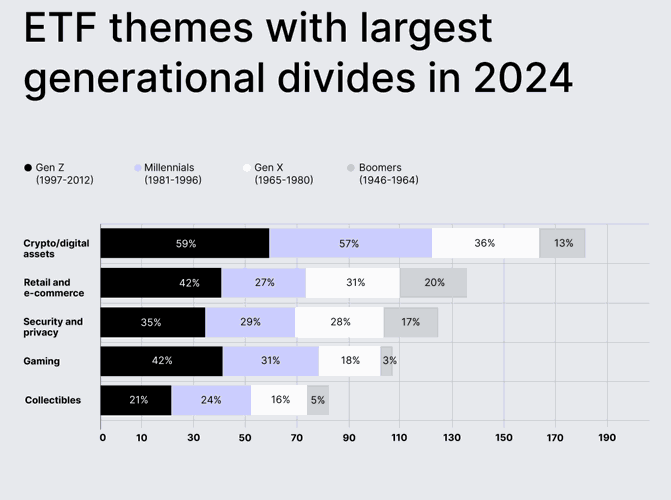

Perhaps the riskiest move is in digital investments. Crypto and blockchain-themed ETFs have seen remarkable take-up among next-generation investors. In 2023 only 26 percent of Gen Z had these ETFs on their books. By 2024 that number reached 59 percent. Millennials saw a comparable increase from 30 percent to 57 percent. Boomers, however, barely budged from 7 to 13 percent.

Pursuing Performance with Wide Eyes

This new generation is not intimidated by volatility. They know the risks. But they also see the potential. And sometimes the returns are too enticing to be ignored.

Take the YieldMax MSTR Option Income Strategy ETF. It generated an astonishing 105.98 percent return. Not a typo. It's the type of return that brings people up short and turns early believers into long-term believers.

Other top performers include Fidelity Growth Strategies, a technology-oriented mutual fund that gained 22 percent annually and foreign-oriented equity ETFs such as Dimensional International Value ETF which has gained 21.44 percent year-to-date. For young investors who grew up in the 2008 crash and the pandemic the message is simple. Safety is not success. Sometimes the greatest threat is being too cautious.

Rethinking the Math of Retirement

It is not just a matter of seeking returns. This change is also a cost matter. ETFs tend to be less expensive than traditional mutual funds and younger investors are increasingly cost-conscious. They know that a one percent fee difference is capable of devouring tens of thousands of dollars over a career. Choosing a cheaper provider or cost-efficient ETF is wiser than that it is required.

Diversification is also on the agenda. Younger investors are not restricting their investments to domestic large-cap stocks. They are investing in emerging markets and alternative assets internationally. This international focus is characteristic of a more opportunity-driven and interconnected worldview than that of their parents.

Why Older Generations Are Staying the Course

Whereas Boomers and most in Gen X hold onto what has always been successful for them. Fixed index funds and healthcare real estate dominate their portfolios. Stability is the objective and they are more apt to select funds with a long history behind them than to run after the new hot thing.

There is sense in this strategy and it cannot be ignored. But the generational divide is increasing and it is raising questions about what retirement will be like for each generation.

Will Gen Z and Millennials see greater returns on their risk-taking or will market volatility validate their beliefs? Will Boomers see more secure returns and forgo growth potential?

The solution probably falls somewhere in middle ground.

A Future Founded on Personal Strategy

Retirement in the modern age is not a cookie-cutter experience. It is a highly individualized financial terrain that is richly rewarded through knowledge flexibility and the willingness to adapt. The future generation of retirees is investing with purpose rather than tradition.

They are not attempting to live their parents' lives. They are attempting to do better.

From AI-driven portfolios to digital asset exposure and the proactive pursuit of cost-effectiveness Millennials and Gen Z are forging a new financial story. They are not leaving behind the learnings of the past entirely. They are simply choosing to write their own story.

The Bottom Line

If you are thinking about whether the classic 401(k) formula still applies to you then now is the time to take a second look. Speak with your advisor. Check out your allocations. Consider your objectives and your tolerance for risk.

Whether or not you are at ease with high-performance ETFs or prefer a more traditional approach the key is to have a plan that is a reflection of who you are and where you are headed. Because ultimately retirement isn't so much about when you retire. It is about having the option to make the decisions of how you wish to live. And that is something that every generation can get on board with.

(0) comments

We welcome your comments

Log In

Post a comment as Guest

Keep it Clean. Please avoid obscene, vulgar, lewd, racist or sexually-oriented language.

PLEASE TURN OFF YOUR CAPS LOCK.

Don't Threaten. Threats of harming another person will not be tolerated.

Be Truthful. Don't knowingly lie about anyone or anything.

Be Nice. No racism, sexism or any sort of -ism that is degrading to another person.

Be Proactive. Use the 'Report' link on each comment to let us know of abusive posts.

Share with Us. We'd love to hear eyewitness accounts, the history behind an article.