Buying your first home in 2026 is an exhilarating milestone, but it can also feel like a second job. Between deciphering market trends and managing your budget, the last thing you want is to get stuck in the weeds of mortgage financing. I remember the frustration of trying to find a straight answer about rates. It often felt like the industry was designed to keep me confused.

But you don't have to navigate this alone anymore. Technology has evolved to put the power back in your hands. Instead of drowning in spreadsheets, tools like the Bluerate AI Agent now act as your personal financial detective, helping you cut through the noise to find the best deal efficiently and privately.

Reasons to Compare Mortgage Rates

You might wonder, "Is it really worth the effort to compare multiple lenders?" The short answer is: absolutely.

In the world of mortgages, knowledge is literally money. A difference of just 0.5% in your interest rate might look small on paper, but over the life of a 30-year loan, it can translate to tens of thousands of dollars in extra interest payments. That is money that could have gone into your retirement fund or home renovations.

However, comparing rates isn't just about finding the lowest number. It's about transparency. Many online marketplaces display "teaser rates", attractive numbers that rely on perfect credit scores and high down payments that most of us don't have. If you don't shop around properly, you risk getting locked into a loan with high fees or working with a lender who can't actually close your deal on time. Comparing lenders ensures you find a partner who understands your specific "Financial DNA."

Bluerate: An Innovative Way to Compare Mortgage Rates

I used to dread the "shopping phase." The moment I filled out a form online, my phone would explode with calls from aggressive telemarketers. It was invasive, stressful, and honestly, outdated. I was trading my privacy for a few generic quotes.

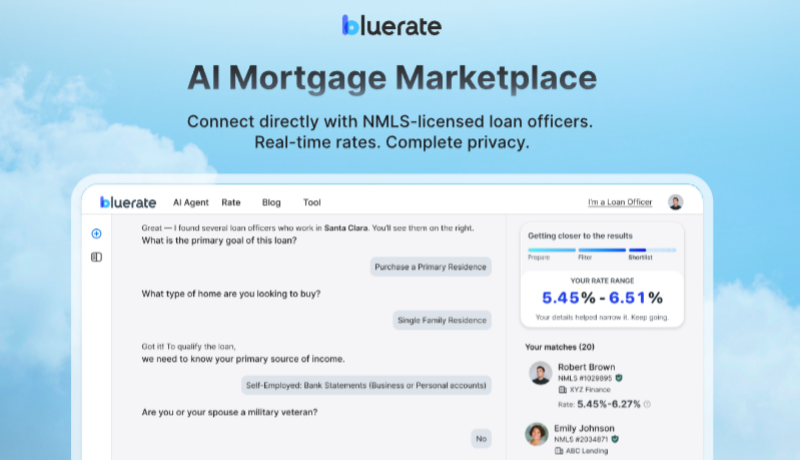

Thankfully, the landscape has shifted. Bluerate has introduced a new standard with their AI Agent. It's not just a search engine. It's a sophisticated marketplace that connects directly to the backend systems lenders use.

Explore More Features:

Real-Time Connection to LOS: Most sites just give you marketing estimates. Bluerate connects directly to the Loan Origination System (LOS). This means the AI runs your scenario against live lending guidelines to show you rates you can actually lock in, not just "bait" numbers.

Privacy First Protocol: This is a game-changer. Bluerate is SOC 2 Type II certified, meaning they adhere to bank-level security standards. Unlike other platforms, they never sell your data. You explore anonymously and only share your contact info when you decide to message a Loan Officer. No more spam calls.

AI-Powered Precision Matching: The AI acts as a matchmaker. It analyzes your location, income type, and goals to pair you with NMLS-verified Loan Officers who specialize in your needs. It filters out the generalists and connects you with experts who have a high "Match Score" for your profile.

Speed and Efficiency: Time kills deals. By collecting and verifying your data upfront, the platform helps you get pre-qualified 2.5x faster than traditional methods. Their data shows this efficiency can speed up the entire closing process by 20%.

Support for Complex Scenarios: If you are self-employed or a gig worker, traditional banks often say "no." Bluerate's AI is trained to handle Non-QM loans and complex income structures, instantly finding lenders who know how to read a 1099 or bank statement.

Transparent "All-in-One" View: From checking your buying power to tracking loan progress, everything happens in one dashboard. You get a clear view of your options without the sales pressure, allowing you to make informed decisions.

Considerations When Comparing Mortgage Rates

Even with powerful AI tools, you need to know what you are looking at. When I compare offers, I always look beyond the headline interest rate.

First, focus on the APR (Annual Percentage Rate). While the interest rate is what you pay on the principal, the APR includes the fees, points, and other costs associated with the loan. It is the true cost of borrowing. A lender might offer a low rate but hide high fees in the fine print. The APR reveals that.

Second, consider the Lender's Specialization. Not all Loan Officers are created equal. If you are looking for an FHA loan or an investment property loan (DSCR), you need a specialist. A generalist might quote you a rate but fail to get the loan approved by underwriting.

Finally, check the Closing Timeline. In a competitive market, being able to close in 21 days versus 45 days can be the difference between getting your dream home or losing it.

FAQs About Comparing Mortgage Rates

Q: Is using Bluerate to compare rates free?

A: Yes. For borrowers and first-time homebuyers, using the Bluerate AI Agent to ask questions, check rates, and find Loan Officers is completely free.

Q: Will checking my rates hurt my credit score?

A: Generally, no. Initial inquiries on the platform are typically "soft pulls," which do not impact your credit score. A hard inquiry usually only happens when you formally apply for a loan with a specific officer.

Q: How does the AI know which lender is best for me?

A: The AI uses a "Prepare-Filter-Shortlist" process. It analyzes your financial profile (credit score, income, loan type) and cross-references it with the guidelines of over 100 lenders to find the best functional match.

Q: Can I use this if I am self-employed?

A: Absolutely. This is one of Bluerate's strengths. The AI helps self-employed borrowers (1099, LLC owners) navigate income verification and connects them with lenders who specialize in Non-QM products.

Q: How do I stop the spam calls?

A: By using Bluerate, you avoid them entirely. Since they don't sell your data as "leads," your phone number stays private until you choose to contact a Loan Officer directly through the platform.

The days of blind mortgage shopping and aggressive sales tactics are over. In 2026, you have the right to transparency, privacy, and speed. You shouldn't have to fight to get a straight answer about what you can afford.

By using intelligent tools, you are doing more than just comparing rates. You are empowering yourself to make a financially sound decision without the stress. Whether you are looking for your forever home or an investment property, don't guess—know.

Stop waiting on callbacks and start getting answers. Chat with the Bluerate AI Agent today to see your real options in minutes.

(0) comments

We welcome your comments

Log In

Post a comment as Guest

Keep it Clean. Please avoid obscene, vulgar, lewd, racist or sexually-oriented language.

PLEASE TURN OFF YOUR CAPS LOCK.

Don't Threaten. Threats of harming another person will not be tolerated.

Be Truthful. Don't knowingly lie about anyone or anything.

Be Nice. No racism, sexism or any sort of -ism that is degrading to another person.

Be Proactive. Use the 'Report' link on each comment to let us know of abusive posts.

Share with Us. We'd love to hear eyewitness accounts, the history behind an article.